No Light Rail in Vancouver!

Did Urban Planners Cause the Next Recession?

The New York Times asks six economists, “Are we in a recession?” Of course, they

don’t agree: one says, “the American economy is slipping into its second post-

If we are entering a recession, most agree that the housing crisis is the cause. And the evidence is overwhelming that the housing crisis was caused by urban planning.

The truth is that only a dozen or so states have had major housing bubbles. Almost

all of these states have passed strict growth-

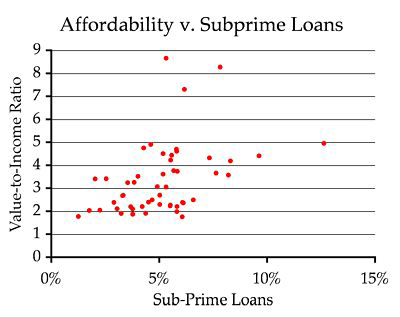

As the chart above shows, there is a definite correlation between housing affordability

(median home price divided by median family income) and the percentage of homes under

sub-

So are we entering a recession? And if we are, will it be armageddon or merely a slowing economy?

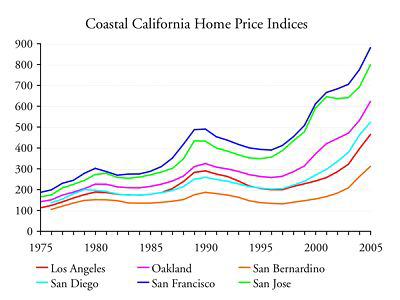

I am no macroeconomist, but experience suggests that housing prices will decline

for several years in the high-

The reason is that housing is an inelastic good, meaning that small changes in supply

can lead to large changes in price. The supply restrictions that come with growth-

The declines in housing prices will definitely hurt some sectors of our economy,

and we may see employment decline for a brief time. But thanks to globalization,

our overall economy is pretty resilient. As one of the New York Times economists

notes, increased exports are likely to help — provided Congress doesn’t do something

stupid like pass another Smoot-

7

Trackback • Posted in News commentary

Reprinted from The Antiplanner